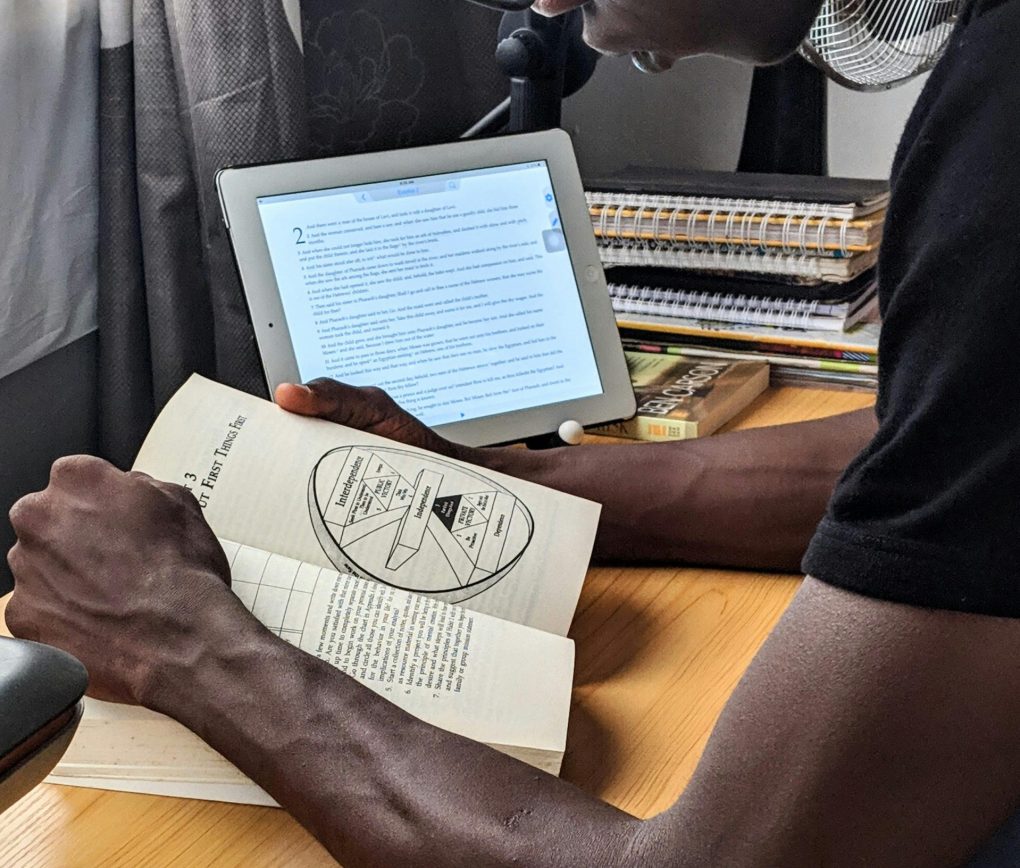

A2F is dedicated to promoting financial inclusion by providing access to financial services for underserved populations, particularly in Nigeria. This focus aims to empower individuals and small businesses that traditionally lack access to banking and financial resources.

This initiative is designed to equip individuals and businesses with the knowledge and skills necessary to effectively manage their finances and make informed decisions.

A2F focuses on supporting entrepreneurs, particularly women and youth, by facilitating access to funding and resources. This support is crucial for fostering entrepreneurship, driving economic growth, and creating job opportunities within marginalized communities.

EFInA launched the Access to Financial Services in Nigeria survey in 2008. Subsequent surveys were undertaken in 2010, 2012, 2014, 2016, 2018, 2020 and 2023.

The EFInA Access to Financial Services in Nigeria survey also known as the A2F Survey is nationwide and covers over 20,000 consumers. All datasets are free and can be accessed on the A2F website.

The A2F survey captures rich data on how Nigerians manage their finances. It also captures non-financial data that is relevant across a range of development programming.

By Dr. Tokunbo Martins

The A2F Survey, which stands for “Access to Financial Services,” is a nationally representative survey conducted in Nigeria. It assesses the access to and use of financial services by Nigerian adults aged 18 and above across all 36 states and the Federal Capital Territory (FCT) of Abuja.

EFInA initiated the A2F Survey in 2008 when financial inclusion was relatively unknown in Nigeria, even among bankers and regulators.

EFInA has conducted a total of seven A2F Surveys, taking place in 2008, 2010, 2012, 2014, 2016, 2018, and 2020.

The sample size has varied over the years. For example, the 2020 survey sampled 27,703 adults and included a booster sample of 1,417 15-17-year-olds.

Please fill this form to download the item.