The Central Bank of Nigeria (CBN) has said that notwithstanding the progress made in the financial inclusion drive, some demographics and areas such as women, youth, micro, small and medium enterprises (MSMEs) as well as rural communities in the Northern region remain disproportionately excluded.

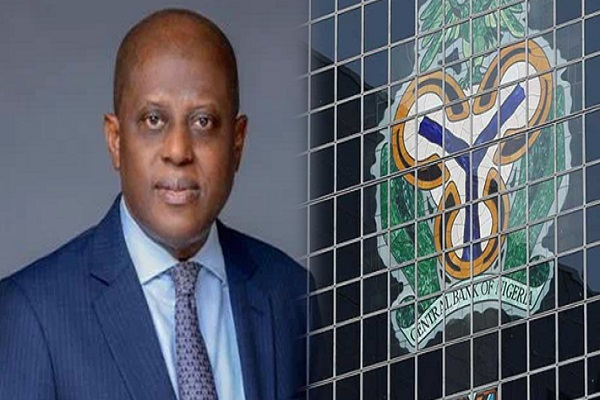

CBN Governor, Olayemi Cardoso, stated this at the Enhancing Financial Innovation and Access (EFInA) 2023 Access to Financial Services (A2F) Survey launch in Lagos.

Represented by the Director of the Other Financial Institutions Supervision Department of the bank, Chibuike Nwagerue, the CBN helmsman said stakeholders are working to address the gaps coupled with the National Financial Inclusion Strategy (NFIS) that has been revised, setting a 95 per cent inclusion goal by next year with a focus on increasing adoption and usage of financial services in priority demographics.

The assurance comes as the financially included adult population increased from 56 per cent in 2020 to 64 per cent this year, according to EFInA’s latest survey released on Wednesday, December 13.

Cardoso said the renewed efforts would ensure robust enabling financial services infrastructure and services, expanding digital financial services (DFS) and improving financial inclusion coordination, capacity as well and governance.

The CBN Governor further said that over the past couple of years, financial inclusion stakeholders have made tremendous efforts in expanding financial service access through the rapid deployment of agents and the development of a mix of products suitable for the financially excluded demographics.

He added that the CBN’s guideline on linking Tier 1 accounts to the Bank Verification Number (BVN) and the National Identification Number (NIN) is to ensure that the banking space is safe for the financially excluded individuals and the economy at large.

Commenting on the survey findings, Cardoso said the survey revealed the need to focus on the financial health of adults, especially in the wake of global economic shocks. He added that financial inclusion stakeholders in the insurance, pension and capital market space have developed relevant policies to address these economic shocks in the MSME sector of the economy.

The CBN boss also stated that inclusive financial systems (IFS) play a crucial role in protecting the most vulnerable individuals and communities from the impacts of global uncertainties by always providing them with access to essential financial services.

He noted that IFS can offer protection through the provision of access to savings and emergency funds, the provision of rails to facilitate digital payments and transfers, and the provision of pathways to access credit, micro-loans, and social safety disbursements in times of crisis among other things.

According to Cardoso, the Nigerian financial system has evolved with significant improvements in size and depth, especially in the areas of market development, products, instruments, and payment infrastructure, among other things, thus reinforcing the need for regulators and stakeholders to constantly keep pace with these emerging developments in a sustainable manner.

He stated that as stakeholders aspire to build a strong and broad-based economy, the focus must be to ensure that the economy can promote growth, efficiency, stability, and inclusiveness in the distribution of the gains of financial development.

The CBN Governor explained that financial inclusion provides the opportunity for equitable distribution of financial resources to support economic growth as well as contributes to the attainment of the apex bank’s goals of monetary policy and price stability.

He averred that financial inclusion is a key developmental objective and a global initiative recognised by several countries worldwide, adding that over 68 countries have developed and are currently implementing an NFIS.

Cardoso commended EFinA for its long-standing support for financial inclusion in the country and its efforts toward accurately measuring the progress through the provision of timely data.

According to him, these efforts, which commenced in 2008, have served as a veritable source of demand-side data that has challenged the ecosystem to create products and develop fit-for-purpose, evidence-based policies, like the recently launched revised National Financial Inclusion Strategy to address the identified gaps.

He said said EFInA, through the A2F survey, has over the past 15 years provided credible data for measuring and promoting financial inclusion in Nigeria to a wide range of stakeholders including regulators, particularly as they serve as a benchmark for tracking and advancing financial inclusion in the country.

His words: “The results have significantly aided financial services providers in developing relevant financial products through a better understanding of consumer’s needs.

“An inclusive financial system that allows broad access to a wide range of formal financial services is essential for better transmission of monetary policy and the attainment of its objectives. Financial inclusion can also boost the health, stability, and soundness of the financial system.

“Growing evidence has revealed that appropriate financial services have substantial benefits for consumers, especially women, youth, farmers, traders, and poor adults. Studies have shown direct linkages of an inclusive economy to growth drivers with a strong correlation between the integration of persons into the formal financial system and reduced income inequality.”