Lagos, 2025. A senior insurance executive sits across from a potential client, passionately explaining the benefits of comprehensive coverage. He knows the statistics by heart, has seen the claims data, and has witnessed families protected from financial disaster by having the right coverage. The pitch is flawless. The client nods along, asks good questions, and promises to “think about it.”

Later that evening, the same executive returns in his car, whose insurance had lapsed two months ago, to a home where the household contents are uninsured. His wife has been asking that they insure the family’s new inverter system after watching their neighbour replace their inverter system the second time in one year. He keeps meaning to sort it out, maybe next month, when things are less tight. He’s not alone.

This isn’t a story about one person. It’s a pattern.

From a recent consumer market insight study conducted between May and August 2025 among insurance professionals using a mixed-methods approach:

- Quantitative survey: 150 insurance sector employees across three major insurers

- Qualitative interviews: 8 in-depth conversations (50% gender split)

- Coverage: Lagos (81%), other Nigerian cities (19%)

- Income profile: 93% earn below ₦350,000/month

Some of our key findings were:

- Less than half have a voluntary insurance policy

- 1 in 3 have never purchased any voluntary coverage

- 19% have dropped their policies entirely

- Many of those who own insurance express doubt, fatigue, or frustration

If the people who sell insurance struggle to buy it, what does that tell us about the insurance ecosystem itself?

For years, Nigeria’s insurance industry has operated on a familiar assumption: low uptake stems from a lack of awareness, education, and trust. If only people knew more, understood better, and trusted deeper, the thinking goes, they would buy.

But what if the most informed people in the market, those with the greatest exposure to insurance, also struggle to purchase voluntary coverage themselves?

We recently conducted research with 150 insurance sector employees across Nigeria to understand this paradox. What we found should concern and galvanise every stakeholder in the Insurance ecosystem.

The Research: Turning the Lens Inward

Rather than surveying the public, we interviewed people working inside insurance companies, analysts, executives, contract staff, and senior leaders. These are individuals who:

- Understand policy structures intimately

- Have access to products at discounted employee rates

- Work daily with claims, underwriting, and customer education

- Should, theoretically, be the industry’s best advocates

The sample consists of 150 full-time employees across three major insurers, 81% of whom are based in Lagos, 93% of whom earn below ₦350,000 monthly, and 78% of whom support dependents.

Our findings show that only 47% currently own voluntary insurance. One in three has never purchased any form of voluntary coverage. Among those who did, 19% have since dropped out entirely, and another 16% have scaled down.

- Attitudes Are Strong—But Insufficient

96% of respondents believe insurance provides valuable financial protection. 67% scored “high” on measures of positive attitude towards insurance. They recommend it to others. They understand the concepts. Yet voluntary insurance ownership remains below 50%. This gap, between believing in insurance and actually buying it, reveals that conviction alone doesn’t drive action.

- The Real Bottleneck: Perceived Behavioural Control

Using the Theory of Planned Behaviour framework, we identified where the system breaks down:

- Attitude (belief in value): 67% score high

- Social norms (peer influence): 54% score high

- Perceived control (confidence to act): Only 36% score high

Even among current insurance policyholders, 64% report low to medium confidence in navigating insurance processes. The issue isn’t just cognitive; it’s operational.

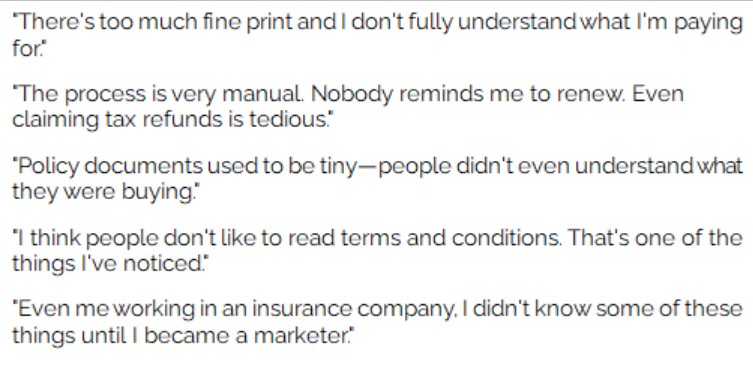

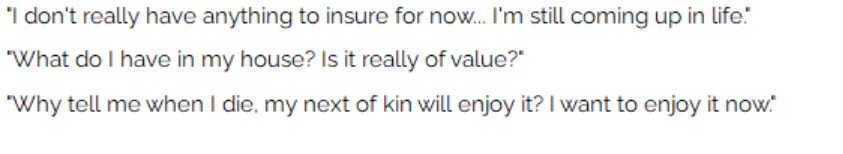

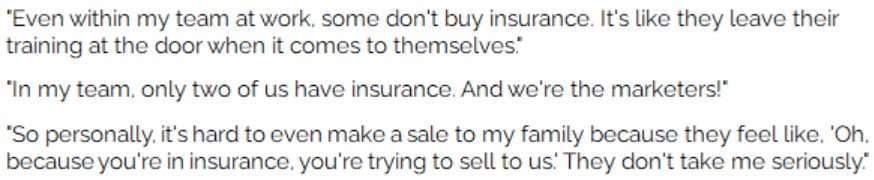

According to the survey respondents:

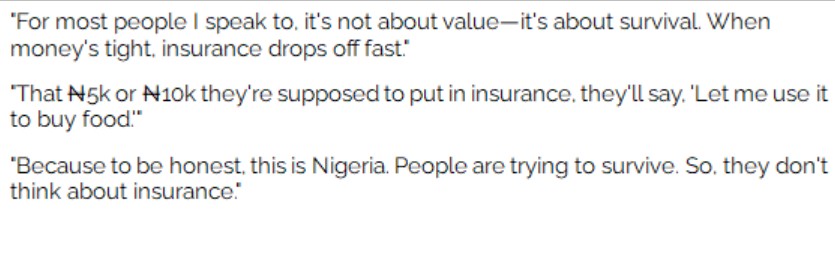

- Affordability Is Relative, Not Absolute

While 91% agree that insurance benefits outweigh costs, 71% are only willing to allocate up to 10% of their income towards premiums. The dominant factor? Cost of living expenses (51%).

According to the survey respondents:

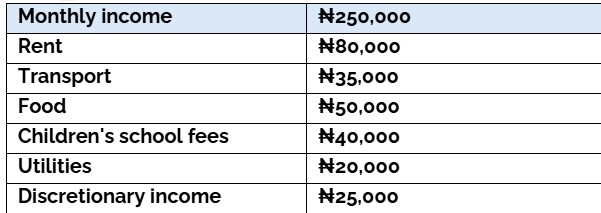

THE MATH THAT MATTERS

Meet “Adeola”, a hypothetical Nigerian adult who represents the proportion of our survey respondents :

When we say, “affordability is relative,” this is what we mean. Insurance premiums (even at ₦5,000/month) aren’t competing with luxury spending. They are competing with the increase in the cost of transport, family emergencies, food, and unavoidable home repairs.

This is proof that perceived value doesn’t translate to budget priorities when competing against essential expenditures

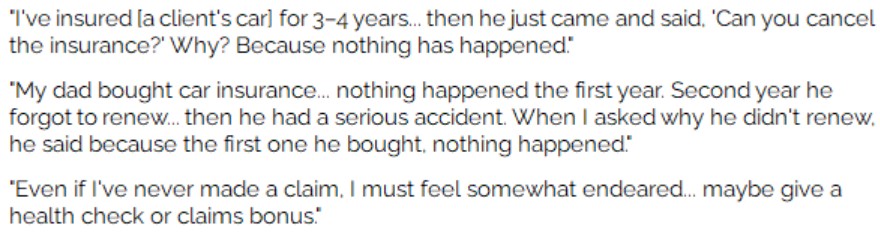

- The Emotional Void: No Claims = No Value

23% of respondents said that not making a claim affects their decision to renew. Another 29% were neutral, suggesting ambivalence when nothing “happens.”

Without claims, many customers never form an emotional or practical bond with their policy. The time between purchase and payout is a silent churn zone.

- Life Stage Misalignment

71% of insured individuals own life assurance or endowment products, but only 16% insure their household contents.

Products designed for established homeowners don’t resonate with younger, lower-asset earners. The market needs modular, life-stage-appropriate solutions.

- Social norms related to insurance might not be sufficient to drive action

While 60% of insured individuals report high social norm influence (they think their peers are using insurance, and there are discussions, peer recommendations, and workplace norms that likely reinforce positive attitudes), that figure drops to 47% among the uninsured.

WHEN IT WORKS: STORIES OF CONVERSION

Our research revealed powerful transformation moments that show what’s possible when the system aligns with human experience:

- The believer:

“Once I saw my baby go through surgery covered by insurance, everything paid, I became a believer. I knew the weight that was lifted.”

- The advocate:

“Those persons who have made a claim will always buy, they will always come back, and they will always advocate. That fear that insurance companies only take money and don’t pay is going away.”

- The planner:

“I get travel insurance yearly, even if it’s low risk, I like the peace of mind. It’s about how you think about the future.”

- The converted sceptic:

“I doubted it initially, surprised that people would put money into something they may never get back. But once I started working in this space, I finally saw what insurance could do.”

These aren’t unicorns. They’re proof points. The question is: how do we create more of these moments, and sustain them over time?

WHAT THIS MEANS FOR THE INDUSTRY

The problem isn’t awareness. It’s enablement.

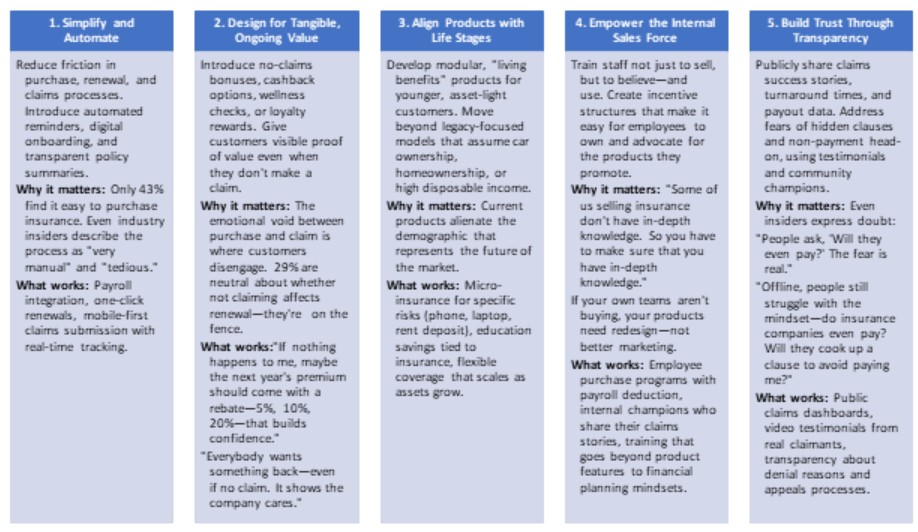

Growth will come not from more education campaigns, but from systemic redesign across five pillars:

THE PATH FORWARD: WHO NEEDS TO ACT

This research points to concrete actions for different players:

For Insurers:

- Audit your employee uptake rates. If your own teams aren’t buying, your products need redesign—not better marketing.

- Test “zero-claim rewards” programmes with small cohorts. Measure retention impact over 12-24 months.

- Make claims turnaround time a public KPI, not a hidden metric. Transparency builds trust.

- Develop life-stage product suites: starter policies for under-30s, family bundles for 30-45s, legacy planning for 45+.

- Create internal champions: incentivise employees to own and advocate for products through their own testimonials.

For Regulators:

- Consider tax incentives beyond Health or incentives that make premiums more affordable for the ₦150k-₦350k income band—the squeezed middle that wants insurance but can’t justify the trade-offs.

- Mandate transparency in claims rejection rates and average payout timelines. Sunlight is the best disinfectant.

- Support innovation in modular, life-stage-appropriate products that don’t require traditional asset ownership.

- Streamline documentation requirements for claims submission to reduce bureaucratic friction.

For Tech Builders:

- The friction points are clear: manual renewals, opaque processes, poor claims tracking. These are solvable problems.

- Build tools that integrate insurance into existing financial flows—not standalone apps that add complexity.

- Create middleware that sits between insurers and customers, providing real-time policy status, automated reminders, and simplified claims interfaces.

- Develop comparison tools that help customers understand what they’re buying in plain language, not insurance jargon.

For Industry Associations and Advocacy Groups:

- Launch public campaigns featuring real claims stories—not abstract benefits. People trust testimonials more than statistics.

- Develop financial literacy programmes that position insurance within life-stage planning rather than as a separate, intimidating product category.

- Create industry-wide standards for policy document clarity and claims process transparency.

For All of Us:

The conversation about insurance needs to shift from “Do you know about it?” to “Can you actually use it?” This isn’t about awareness anymore; it’s about aligning the system with how Nigerians actually live, earn, and decide.

Nigeria’s insurance penetration will grow when a young intern watches insurance replace her colleague’s stolen laptop in days, not months. When an Uber driver knows his claim will be processed fast enough to keep his business running. When a civil servant can renew or modify her coverage from her mobile banking app. When a young family earns rewards for claim-free years, instead of feeling they wasted money.

The data is clear. The barriers are known. The opportunity is massive.

The paradox of insurance insiders not buying insurance isn’t a failure of individuals; it’s a mirror reflecting systemic barriers. If we can fix the system for those who understand it best, we unlock scalable models for the entire ecosystem.

The question isn’t whether Nigerians understand insurance. It’s whether the system is designed for them to act on that understanding.

Take Action

Share Your Story

What’s your honest experience with insurance, as a buyer, seller, or sceptic? Your story matters. Drop a comment or reach out at info@efina.org.ng.

Share This Research

Know someone in insurance, fintech, or policy? Forward this post. Real change happens when insights reach decision-makers.

Let’s make this conversation real. The industry doesn’t need more reports gathering dust. It needs action. And action starts with honest dialogue.